Content

Rising interest rates are expected to boost their profit margins in the coming quarters. Furthermore, we have also included some leading names from the consumer goods and home improvement retail sector. These stocks have been ranked according to the hedge fund sentiment as of Q3 2022. Bond funds behave similarly to stocks in an environment of rising interest rates. That is why many investors will rush to buy short- or intermediate-term bonds, expecting that rates may continue to rise on long-term bonds.

- It also means that banks can earn more from the spread between what they pay savers for savings accounts and certificates of deposit and what they can earn from highly-rated debt like Treasuries.

- Perhaps the most important thing to remember when thinking about the effects of interest rate changes is that bond prices and returns move in the opposite direction of interest rate changes.

- The economic inactivity rate decreased by 0.4 percentage points to 20.8% in March to May 2023, the Office for National Statistics reports.

- The U.S. dollar had pared losses against other major currencies after the report while stock indexes were in the red across the board.

- The 13 increases in UK interest rates since December 2021 could now be hitting demand for workers, says Kitty Ussher, chief economist at the Institute of Directors.

For income-oriented investors, a reduction in the federal funds rate means a decreased opportunity to make money from interest. A decrease in interest rates will prompt investors to move money from the bond market to the equity market. While it usually takes at least 12 months for a change in this interest rate to have a widespread economic impact, the stock market’s response to a change is often more immediate.

These Sectors Benefit From Rising Interest Rates

It can change daily, and because this rate’s movement affects all other loan rates, it is used as an indicator to show whether interest rates are rising or falling. Conversely, higher interest rates mean that consumers don’t have as much disposable income and must cut back on spending. When higher interest rates are coupled with increased lending standards, banks make fewer loans. The interest rate that impacts the stock market is the federal funds rate.

These four major risk factors are the most important in explaining the behavior of most investments. Although the focus of today’s article is LTB risk, to get an accurate measure, it is important to control for the other risk effects at the same time. That is why our risk model uses multiple regression analysis in which we regress monthly returns against monthly changes in all four risk factors simultaneously. That allows us to disentangle the various risk effects from each other and present a more accurate picture of the true risk factor sensitivities. “The US economy continues to run hot – the labour market is extremely tight and a number of executives we spoke to described their challenges in retaining staff and preventing competitors from poaching talent. Industrial companies in particular continue to see record backlogs, with the easing of logistics and supply chain constraints only just starting to have an impact on deliveries and lead times.

US wholesale inflation slows to a crawl

Interest rates on other types of financing like credit cards, car loans and payday loans also increase. And that health usually means that borrowers have an easier time making loan payments and banks have fewer non-performing assets. It also means that banks can earn more from the spread between what they pay savers for savings accounts and certificates of deposit and what they can earn from highly-rated debt like Treasuries. Boasting margins that actually expand as rates climb, financial entities like banks, insurance companies, brokerage firms and money managers generally benefit from higher interest rates. The asset manager recently launched a dozen new investment strategies, including life science and growth equity businesses.

- This industry can also see higher demand during tough times, including pandemics.

- Despite the rise in headline wage growth, real pay when taking inflation into account was down 0.8%, the ONS data showed.

- MPs have heard that rising mortgage rates are causing financial stress to customers, and that the situation will worsen.

- In the second fiscal quarter, the Royal Bank of Canada reported a net income of CAD 4.0 billion, up from CAD 2.5 billion from the prior year.

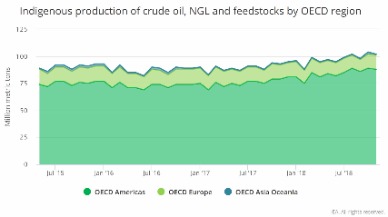

The IEA still believes oil demand will hit a record high this year but factors such as interest rate hikes mean the increase will be slightly less than anticipated. The 0.1% contraction in gross domestic product (GDP) between April and May tells the Bank of England that the jump in interest rates over the previous 18 months has only had a mild dampening effect on the economy. UK lenders have reported the biggest increase in mortgage defaults since the aftermath of the financial crisis. This fall in wholesale inflation should feed through to consumers in coming weeks and months. Favourable geopolitical developments such as the collapse of the USSR, the rise of China and growing labour forces led to “much lower increases in prices and wages than would normally happen”, he says. The 0.1% contraction in gross domestic product between April and May tells the Bank of England that the jump in interest rates over the previous 18 months has only had a mild dampening effect on the economy.

Best Stocks and Sectors for Rising Interest Rates

MPs have heard that rising mortgage rates are causing financial stress to customers, and that the situation will worsen. However, lenders also reported that they have not seen a significant pick-up in arrears yet. For example, most people know that health insurance is extremely important, especially since healthcare costs are the leading cause of bankruptcy in the U.S. This industry can also see higher demand during tough times, including pandemics. This sector tends to have above-average performance during inflation and increasing rates, thanks to higher oil prices. Financial services, which can include banks, insurance firms and brokerage companies, is one of the key industries that benefits from a sharp rise in interest rates.

He says Nationwide saw a high take-up of payment holidays in Covid, with over 200,000 customers taking it up. Speaking to broadcasters as he travels to the NATO leaders summit, the Prime Minister acknowledged “things are difficult” for families across the country amid a rise in interest rates. The IMF says it is critical to improve UK health outcomes, due to the long-term sickness that has driven the post-pandemic spike in inactivity.

Credit-Based Yield

Financials tend to perform strongly in a rising interest rate environment (depending on the health of the overall market). Investors could see solid returns in defensive sectors as investors look to allocate their gains in sectors that are generally considered stable during market downturns. An environment where interest rates are rising amid signs of an improving economy can also offer opportunities for investors within the equity space. To find such opportunities, it can be helpful to examine the sectors within the stock market that tend to benefit from higher rates in a healthy economy. But several other sectors benefit from increasing interest rates since they usually signify a strengthening economy.

Analysts were forecasting $1.95 in per-share earnings from $10.5 billion in sales. Total revenue jumped to $12.34 billion from $6.31 billion a year earlier, topping estimates for $11.01 billion due to selling more goods at full price and relying less on markdowns. Looking ahead, the global sporting goods company offered a better-than-expected sales outlook for the upcoming year, driven by the enthusiasm surrounding its women’s category, apparel business and Jordan brand. Still, many investors will be skeptical of pouring capital into the largest Canadian bank by market capitalization.

This morning’s data comes just hours after Bank of England governor Andrew Bailey and chancellor Jeremy Hunt called for wage and price restraint to help the fight against inflation. New data just released this morning shows that average pay (excluding bonuses) rose by 7.3% year-on-year in March to May 2023, the joint-highest reading on record (matching a peak seen during Covid-19 lockdowns). This is the 12th consecutive fall in vacancies, as the jobs market returned to normal after the worker shortages following the Covid-19 pandemic. “However, there are also some hopeful signs, with the number of vacancies falling and more people coming out of inactivity back into the labour market.

As a result, it has secular growth opportunities, which the company demonstrated by reporting $95 billion in asset inflows in an extremely difficult macroeconomic environment in 2020. After a brutal 2020, rising interest rates are bringing cheer to bank stocks because higher rates lead to net interest margin expansion and healthier profits. However, rising interest rates and inflation, which erodes the value of cash, aren’t bad news for some industries, according to Steven G. DeSanctis, an equity strategist at Jefferies. The Federal Open Market Committee (FOMC) of the Federal Reserve will meet for two days on Tuesday and Wednesday to discuss interest rates and monetary policy. While many expect the Fed to maintain its accommodative policy, investors will be closely monitoring comments on inflation and the central bank’s economic outlook during a press conference on Wednesday.

Now, with the economy whirring back to life, the stimulus money will dry up, but there is another way of looking at this. New York-based BlackRock is the largest asset manager in the U.S., with $9.007 trillion in AUM at the end of March 2021. Much like Morgan Stanley, BlackRock is a prized stock within the financial services industry. It’s a dominant company considered too big to fail because of its economic size and financial muscle. But even if a stock is boring, it doesn’t mean you should not invest in it. Morgan Stanley’s large exposure to investment banking means it consistently outperforms bank stock peers, a bonanza for investors during the current trading boom.

If enough companies experience declines in their stock prices, the whole market, or the key indexes many people equate with the market—the Dow Jones Industrial Average, S&P 500, etc.—will go down. With a lowered expectation in the growth and future cash flows of a company, investors will not get as much growth from stock price appreciation. Furthermore, investing in equities can be viewed as too risky when compared to other investments. Ultimately, you have to adjust your fixed-income portfolio to account for rising rates. Of course, that does not mean you have to chuck out all of your investments to favor companies that benefit from the economic health dividend indicated by rising rates. But it would help if you kept the stocks in this list in mind moving forward.

But added she has “increased the number of [leak fixing] gangs out there” and Thames Water is “literally fixing a leak every seven and a half minutes, that hasn’t happened before”. The IMF suggests that the Bank of England might have to maintain higher interest rates for an extended period. Labor supply, which has just reached its pre-pandemic level, has also been weaker than peers. As in other advanced economies, https://g-markets.net/helpful-articles/the-5-different-types-of-doji-candlestick-patterns/ productivity growth has been sluggish, reflecting a slower pace of innovation and technological diffusion. And in a stern assessment of Britain’s economic progress, the Fund says that the UK, once a “strong performer”, has now lost economic momentum. That might be a tipping point at which options such as interest only won’t be sufficient to offset the increase in payments that customer will see.

Commodity prices usually rise when inflation is accelerating, and therefore some choose to invest in this asset class to hedge against inflation. Investing with portfolio managers who have a flexible approach can help you preserve your capital. These professionals are able to make changes to sector weightings and duration exposures as per market and interest rate swings. Whether you’re a novice investor or are very experienced, it’s always a good idea to consult a financial professional about any changes you make to your investment portfolio or strategy.

Recent Comments